Insurance that covers and protects against cyberattacks

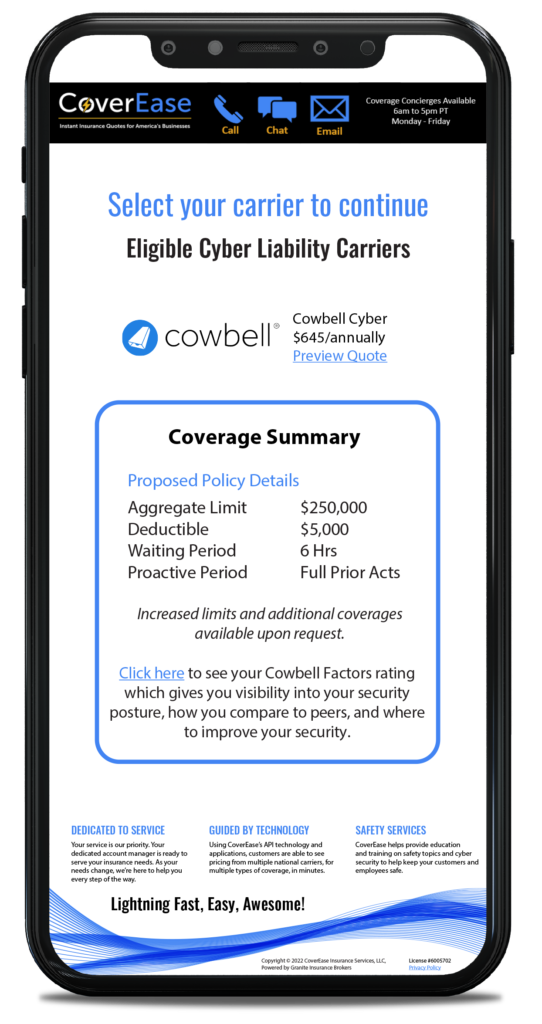

CoverEase is proud to offer technology-driven cyber insurance alongside cyber risk reduction resources through Cowbell Cyber, with premiums starting at $450 a year.

Rob Sobers, a software engineer specializing in web security reported to Varonis:

- 95% of cybersecurity breaches are caused by human error

- The average cost of a data breach is $3.86 million as of 2020

- And the average lifecycle of a breach was 280 days from identification to containment

- The cost of lost business averaged $1.52 million

In under 3 minutes, get an instant cyber liability quote that includes risk reduction management and employee training, at no additional cost.

Statistics

A small business is hacked roughly every 19 seconds, and 25% of small businesses filed for bankruptcy protection after a data breach. These numbers highlight how small businesses are at higher risk from cyber threats.

Internal Errors

95% of data breach incidents are caused by employee mistakes, which shows the lack of cybersecurity awareness among many working professionals. Human error and software vulnerabilities are constant threats to a business’s security operation.

Underestimated Risk

Although nearly half of cyberattacks affect small businesses, many are unaware of the risk, simply because cyber incidents often go unreported at small businesses.

Why Cyber Insurance?

With cyber attacks, especially ransomware attacks that are on the rise, cyber insurance has become more important in helping keep small businesses safe. It is estimated that 43% of cyber-attacks are aimed at small businesses, but only 14% of small businesses are ready to defend themselves.

The Costs of Cyber Incidents

Why We Recommend Cowbell Cyber?

Cowbell’s cyber policies are admitted, written on “A” rated paper, and available nationwide. Cowbell’s goal is to deliver value to policyholders on day one with a closed-loop approach to risk management that includes: continuous risk assessment, recommendation for risk improvement, and cybersecurity awareness training for every employee.

Here are a few risk factors small businesses should consider:

- Statistics. A small business is hacked roughly every 19 seconds, and 25% of small businesses filed bankruptcy protection after a data breach. These numbers highlight how small businesses are at higher risk from cyber threats.

- Internal Errors. Human error and software vulnerabilities are constant threats to a business’s security operation. 88% of data breach incidents are caused by employee mistakes, which shows the lack of cybersecurity awareness among many working professionals.

- Underestimated Risk. Although nearly half of cyberattacks affect small businesses, many are unaware of the risk, simply because cyber incidents often go unreported at small businesses.

- Cowbell Cyber makes cyber insurance easy by delivering customized, stand-a-lone cyber policies with robust coverages tailored to the unique needs of your business. In connection with CoverEase, their AI-powered customized policies bring value through continuous risk assessment, risk improvement resources, and cybersecurity training for employees.

Reasons to get Cyber insurance

View the full document here

- Mitigate financial loss from a cyber incident

- Recover quickly from a cyber incident – Cowbell brings experts when you need them.

- Visualize and monitor your risk exposure, implement training to increase cyber resilience

Already have a cyber Endorsement?

Most endorsements don’t provide adequate coverage in today’s cyber environment. View our comparison here.

At a high level:

- Claims not handled by cyber experts

- Limited only to data breach incidents

- Business interruption from cyber incidents excluded

- No coverage for social engineering (phishing)

- No coverage for ransom payments

- Additional risk improvement services not offered

- Lack coverage clarity, high rate of claim denial

Let’s talk coverage

Cyber Insurance offers two types of coverage: first-party and third-party. First-party coverage includes a company or persons own damages from covered cyber losses. Third-party coverage offers protection when a customer or partner sues you for allowing a data breach to happen.

Cowbell’s coverage delivers financial protection and coverage for the wide range of cyber incidents that impact businesses nowadays, including network incidents, email scams, ransomware attacks, cybercrime, social engineering and more.

Coverage Overview

Security Breach expense: Coverage for losses and incident recovery expenses such as forensic investigation or customer notification

Extortion Threats: Coverage for costs associated with ransoms related to cyber intrusions into business systems

Replacement or restoration of data: Coverage for the costs to replace or restore data or programs in the aftermath of an incident

Loss of Business Income: Coverage for losses and costs associated with the inability to conduct business due to a cyberattack

Public Relations Expenses: Coverage for the costs to hire a public relations firm to restore reputation follow a cyber incident

Security breach liability: Coverage of costs, if liable, incurred by customers and other third parties due to a cyberattack

Computer and funds transfer fraud: Coverage for the losses associated with a fraudulent transfer of money, securities, or other property

Social engineering: Coverage for losses associated with social engineering incidents

Ransom payments: Coverage for the reimbursement of ransom payment to a third party to resolve an extortion threat

Post Breach remediation: Coverage for labor costs to remediate security weaknesses identified by an independent security firm

Hardware replacement costs: Coverage for the cost to replace destructed or corrupted equipment after a cyber incident

Telecommunication Fraud: Coverage for the cost of unauthorized use of the insured’s telephone system following a cyber incident