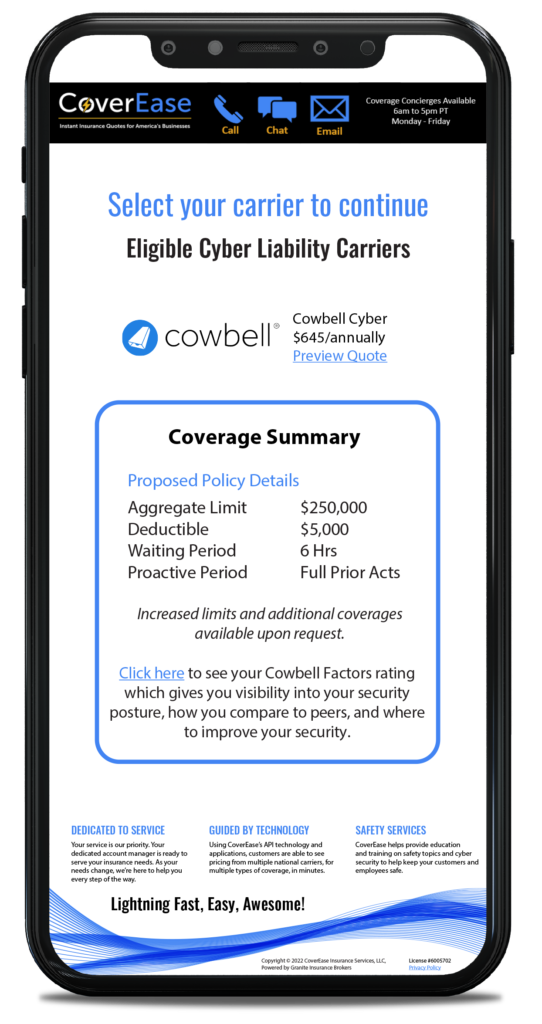

CoverEase is proud to offer technology-driven cyber insurance alongside cyber risk reduction resources through Cowbell Cyber, with premiums starting at $450 a year.

Rob Sobers, a software engineer specializing in web security reported to Varonis:

A small business is hacked roughly every 19 seconds, and 25% of small businesses filed for bankruptcy protection after a data breach. These numbers highlight how small businesses are at higher risk from cyber threats.

95% of data breach incidents are caused by employee mistakes, which shows the lack of cybersecurity awareness among many working professionals. Human error and software vulnerabilities are constant threats to a business’s security operation.

Although nearly half of cyberattacks affect small businesses, many are unaware of the risk, simply because cyber incidents often go unreported at small businesses.

With cyber attacks, especially ransomware attacks that are on the rise, cyber insurance has become more important in helping keep small businesses safe. It is estimated that 43% of cyber-attacks are aimed at small businesses, but only 14% of small businesses are ready to defend themselves.

Cowbell’s cyber policies are admitted, written on “A” rated paper, and available nationwide. Cowbell’s goal is to deliver value to policyholders on day one with a closed-loop approach to risk management that includes: continuous risk assessment, recommendation for risk improvement, and cybersecurity awareness training for every employee.

Most endorsements don’t provide adequate coverage in today’s cyber environment. View our comparison here.

Cyber Insurance offers two types of coverage: first-party and third-party. First-party coverage includes a company or persons own damages from covered cyber losses. Third-party coverage offers protection when a customer or partner sues you for allowing a data breach to happen.

Cowbell’s coverage delivers financial protection and coverage for the wide range of cyber incidents that impact businesses nowadays, including network incidents, email scams, ransomware attacks, cybercrime, social engineering and more.

Security Breach expense: Coverage for losses and incident recovery expenses such as forensic investigation or customer notification

Extortion Threats: Coverage for costs associated with ransoms related to cyber intrusions into business systems

Replacement or restoration of data: Coverage for the costs to replace or restore data or programs in the aftermath of an incident

Loss of Business Income: Coverage for losses and costs associated with the inability to conduct business due to a cyberattack

Public Relations Expenses: Coverage for the costs to hire a public relations firm to restore reputation follow a cyber incident

Security breach liability: Coverage of costs, if liable, incurred by customers and other third parties due to a cyberattack

Computer and funds transfer fraud: Coverage for the losses associated with a fraudulent transfer of money, securities, or other property

Social engineering: Coverage for losses associated with social engineering incidents

Ransom payments: Coverage for the reimbursement of ransom payment to a third party to resolve an extortion threat

Post Breach remediation: Coverage for labor costs to remediate security weaknesses identified by an independent security firm

Hardware replacement costs: Coverage for the cost to replace destructed or corrupted equipment after a cyber incident

Telecommunication Fraud: Coverage for the cost of unauthorized use of the insured’s telephone system following a cyber incident

Insurance services provided by CoverEase Insurance Services, LLC and its licensed agents and affiliates. The information contained within these materials are confidential and not to be distributed. Descriptions are general in nature only. Please refer to the terms and conditions of policies offered or purchased. Insurance products are subject to application and underwriting requirements. Pricing depends on a variety of factors including policyholder location. Not all discounts available in all states. Not all products available in all states. Use of and access to this information, site or any of the links contained within this site does not create a relationship between the user and CoverEase. © 2025 CoverEase, Inc. All Rights Reserved.