Get instant workers’ compensation and liability quotes online in minutes.

Send your request to CoverEase and we’ll get the quoting process started!

Prefer to speak with a CoverEase Specialist?

Call (888) 611-3273 (EASE)

Email us quotes@CoverEase.com

Our specialists are here to help ensure you have the right kind of business insurance that’s made to meet your company’s unique needs.

Making sure you have the appropriate business insurance is an important part of running a business, and CoverEase is at your service. Bundling your business insurance together can also provide you discounts and benefits.

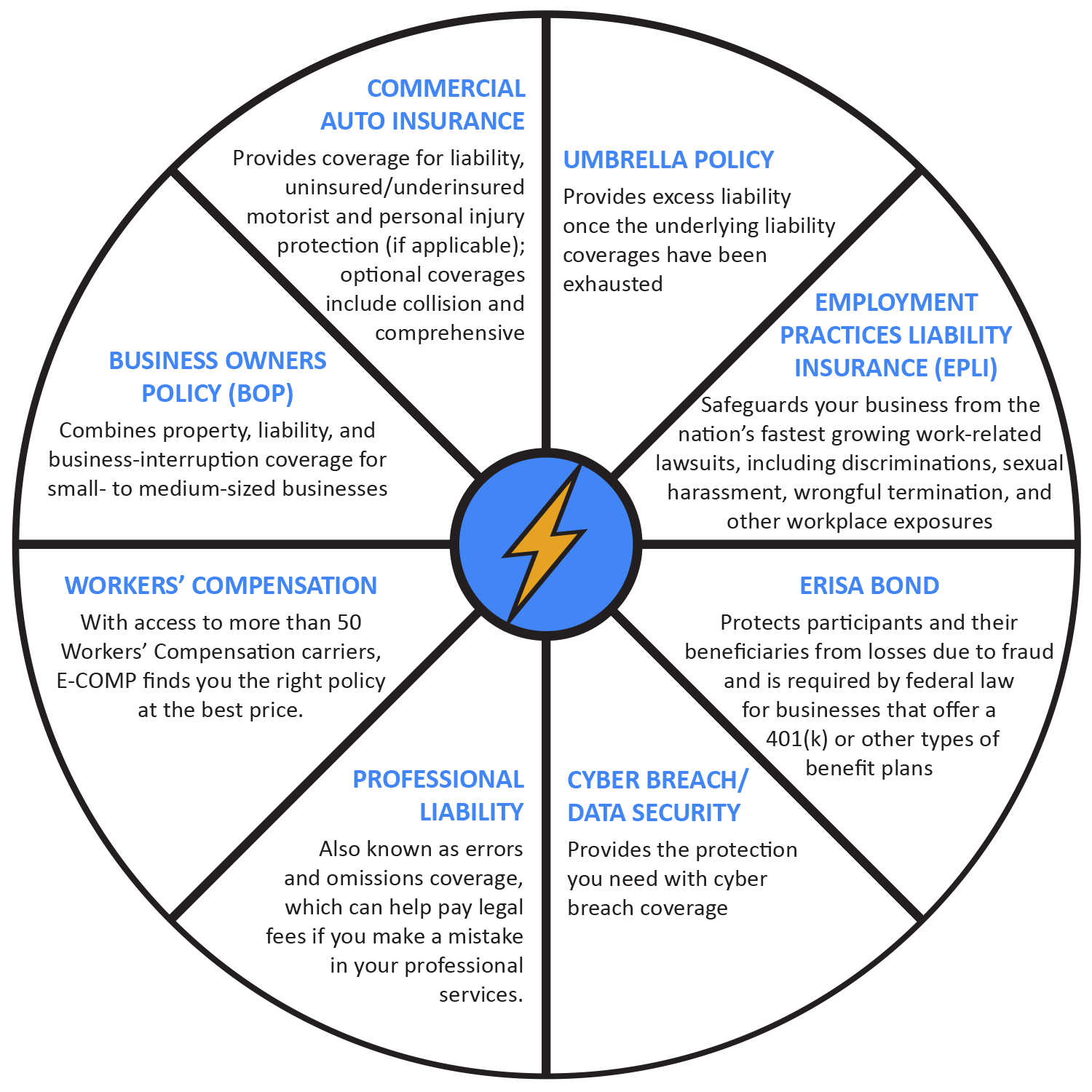

There are many types of insurance policies that protect the company you’ve worked hard to build, including coverage for business property damage, legal liability and employee-related risks.

In most states, your business needs certain coverages, like workers’ compensation insurance and unemployment insurance to operate.

LEARN MOREIf you have a board of directors helping to run your company, they are at risk of lawsuits from many other interested parties and they can be sued over their management decisions.

LEARN MORE

Professional liability insurance, also known as errors and omissions coverage, which can help pay legal fees if you make a mistake in your professional services.

LEARN MORECyber Risk and Data breach insurance help to cover the costs of responding to and managing data breaches and cyber breaches.

LEARN MORE

Most EPLI policies are written to cover a broad range of employees’ workplace claims against a business.

LEARN MOREBusiness auto insurance helps cover you and your employees if you’re in an accident while driving for work.

LEARN MORE

Commercial umbrella coverage gives you extra liability coverage to help pay costs that exceed your general liability or other liability policy limits.

LEARN MOREThe business owner’s policy is a bundled policy that typically includes business property including computers, inventory and tools, liability, loss of income coverage from a covered loss and non-owned auto liability.

LEARN MORE

Insurance services provided by CoverEase Insurance Services, LLC and its licensed agents and affiliates. The information contained within these materials are confidential and not to be distributed. Descriptions are general in nature only. Please refer to the terms and conditions of policies offered or purchased. Insurance products are subject to application and underwriting requirements. Pricing depends on a variety of factors including policyholder location. Not all discounts available in all states. Not all products available in all states. Use of and access to this information, site or any of the links contained within this site does not create a relationship between the user and CoverEase. © 2022 CoverEase, Inc. All Rights Reserved.